Your community

Your benefits

Support us

Support our work

Help us create a greener, healthier, and fairer world by making a donation to our research or student support.

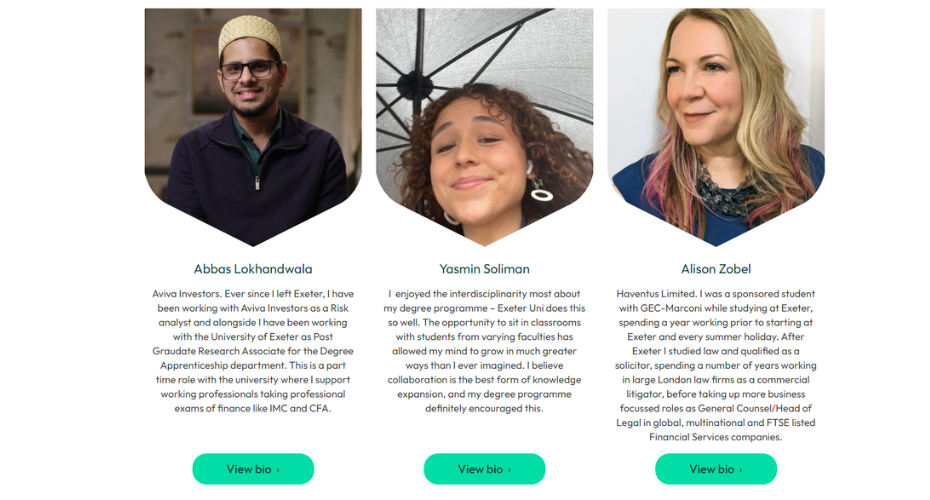

Check out our alumni profiles

Browse through written and video profiles to learn from alumni expertise and discover more about career paths and industries.

Stay connected