Purchasing cards

What is a purchase card?

The University's purchase cards are credit cards designed for corporate use for purchasing one-off, low-value items under £1,000.

When to use a purchase card

- Do use purchase cards to pay for things like conference/seminar fees and subsistence costs while traveling on authorised University business.

- Don't use purchase cards to buy goods and services from the University's approved suppliers list. Search the University Supplier List. These items should be ordered with purchase orders - see Purchase Orders for training on how to create a PO.

- Don't use purchase cards to book and pay for travel or accommodation - these must be booked through one of the University's travel agencies - Click Travel or Key Travel. See the Travel section for more details.

- These cards cannot be used to obtain cash.

Full details are in the Purchasing Card Policy.

How to apply

To apply for a purchase card, please discuss your requirements with your line manager and then complete the Purchase Card Application Form.

If accepted, you will be contacted to arrange training on the use of the card, the University's terms and conditions and the reconciliation process.

The card will be issued only once the training has been completed. Please note that purchase cards can take up to one month to be processed and dispatched to the cardholder subject to all mandatory requirements being completed.

Cardholder Purchase Card Terms and Conditions must be read and agreed to when submitting an application.

All purchases made on a University Purchase Card must be in adherence with the Purchasing Card Policy

HSBC Contact Numbers

In the event of the loss, theft or fraudulent usage of an individual’s purchase card, the cardholder must immediately report it to:

Fraudulent Transactions:

- Contact details can also be found on the back of your purchase card or,

- Telephone (UK)– 03456 015 934 or Overseas +44 1226 261 053

- 24 hour lost or stolen (UK) 0800 032 7075 or Overseas +44 1442 422 929

- Mark the transaction as under dispute in T1.

Fraudulent transactions must be reported to HSBC by the cardholder within 120days of the activity taking place. If it is not reported within this time, HSBC reserve the right to not refund the fraudulent transactions and the cost of this will be charged to the budget or project.

Lost or Stolen Cards (Open 24 hours a day, 365 days per year):

-

- Telephone (UK) 0800 032 7075 or Overseas +44 1442 422929

- Please also email accountspayableenquiries@exeter.ac.uk to advise that you have contacted HSBC and will be issued with a new card.

If your card transaction has been declined, first check with HSBC Dedicated Corporate/Purchasing Card Services on 03456 015 934 or overseas +44 1226 261 053 (8am to 10pm UK time daily) to find out why.

Plesae be aware HSBC to sometimes decline transactions if you normally purchase in GBP and suddenly they see items in a different currency. If this happens plesae do just contact them to advise : 0345 601 5934

If the transaction was declined because a merchant category is currently blocked on the card, please ask HSBC to confirm which category has caused this. Then send full details (including the category number given by HSBC) to procurement-operations@exeter.ac.uk for their consideration.

If the transaction was declined due to the risk of card fraud taking place with a telephone transaction, contact the retailer to find out if they offer an online payment method instead.

| Country | Local Rate Number |

| Austria | 0800 070663 |

| Belgium | +32 22903114 |

| Cyprus | +357 26030109 |

| Czech Republic | +42 0228883586 |

| Estonia | +37 26093063 |

| Finland | +358 942451623 |

| France | +33 170385667 |

| Germany | +49 23497849040 |

| Greece | +30 2111987328 |

| Ireland | +353 15369556 |

| Italy | +39 0 645200817 |

| Latvia | +371 66163161 |

| Lithuania | +370 37999282 |

| Luxembourg | +352 27872543 |

| Malta | +356 27780279 |

| Netherlands | +31 207988087 |

| Poland | +48 128812809 |

| Portugal | +351 308806303 |

| Slovakia | +42 1482302926 |

| Slovenia | +386 18888354 |

New Reconciliation Process from 3rd July 2023

Finance Services are pleased to announce several improvements to the purchasing card reconciliation process which will be going live in T1 on 3rd July 2023.

The improvements include:

- Transactions will be loaded directly into 'My Travel and Expenses' in T1, replacing all reconciliation activity currently carried out in the Core Enterprise Suite function (commonly called Ci).

- Reconciliations will be quicker as more fields will be auto filled by T1, including dates and transaction values. Subsequently, keying errors will also reduce.

- All transaction information will only need to be entered once so no more duplication in different sections within T1.

An email has been sent to all cardholders and reconcilers to give initial details about the changes and what preparations are needed for a smooth transition:

- Timeline

- 16th June - 3rd July

- Two week gap where HSBC transactions have temporarily stopped being loaded into T1.

- Cards can still be used for purchases as normal - use HSBC's MiVision to keep up to date with card activity.

- Finance Systems team will carry out final testing of new process.

- Any remaining transactions currently in T1 in the existing statement (in Core Enterprise Suite) should be reconciled as soon as possible.

- Please see Purchase Card Reconciliation in Core Enterprise Suite (Ci) for details of how to reconcile any remaining transactions as the Travel and Expense Matching method is no longer available.

- 3rd July

- Cardholders and reconcilers will be emailed to confirm new process has gone live.

- Guides covering the new reconciliation process will be available on the purchase cards training page.

- 16th June - 3rd July

- Training

- Short online Teams workshops covering the changes will run throughout June and July – training is mandatory for all cardholders and reconcilers - please book here.

- Cardholders who do not reconcile their own cards will only need to attend the first section of the workshop. Reconcilers will need to attend the full workshop.

- In addition, the existing step-by-step reconciliation guides will be updated with the new process in time for 3rd July launch.

- Use of cards during the changeover period

- It is essential that all cardholders and their reconcilers can access HSBC's MiVision. Please advise accountspayableenquiries@exeter.ac.uk of any access issues as MiVision is the only way to check transactions and look out for fraudulent activity while the T1 statements are unavailable from 16th -30th June.

- The reconciliation changes in T1 will NOT affect use of the card itself, and any purchases needed can continue to be made as normal.

- However, we would ask cardholders to plan ahead and where possible, reduce/avoid the use of the card throughout June to reduce the backlog of transactions loaded into T1 in July

- It is essential that all cardholders and their reconcilers can access HSBC's MiVision. Please advise accountspayableenquiries@exeter.ac.uk of any access issues as MiVision is the only way to check transactions and look out for fraudulent activity while the T1 statements are unavailable from 16th -30th June.

Further communications and reminders will be sent out as we reach each stage of the transition process during the next few months and this information will also be replicated here.

If you have any queries or concerns about the transition, please contact financehelpdesk@exeter.ac.uk 01392 726981 to discuss these as soon as possible.

FAQs

If your supplier will accept a credit card payment and it's for a one-off purchase, then you can ask any colleague with a University purchasing card to use it on your behalf. They'll need to know:

- Which budget centre or project code is paying for this item.

- The budget holder has given permission for this purchase.

Or if there isn't anyone near you with a card, then you can request the Procurement Operations team purchase the item on your behalf. Email procurement-operations@exeter.ac.uk with:

- Details of the item to be purchased - attach the invoice or include a web-link to the item.

- The total cost - if there is VAT and any delivery/service charge, make sure these amounts are included.

- The full budget centre or project code that will be used to pay for this item.

- If you are not the budget holder, please provide the name of the budget holder who has given permission for this purchase.

- The delivery address for this item, if being delivered.

- Your contact phone number in case of queries.

Ideally, purchasing cards are used for one-off purchases from suppliers that are not likely to be used again. Typically these will be goods purchases, conference bookings or travel bookings that cannot be made through the University's travel provider.

If you intend to use the same supplier again, see University Suppliers for details of how to set them up in T1 for purchase orders instead.

Purchases of services should be assessed for compliance with HMRC's IR35 regulations - please see the process to follow to pay for services.

HSBC are updating the way card payments are authenticated by adding an additional layer of security to protect you and help fight fraud. This is known as Strong Customer Authentication (SCA).

Currently, for some card payments, Cardholders need to verify the payment by entering a One-Time Passcode (OTP). Soon, for payments that require SCA, we’ll also use a Cardholder’s Behavioural Biometric Data.

What’s changing?

HSBC will begin to ask Cardholders to type in their business email address when authenticating payments, to help build their behavioural biometric profile.

What is Behavioural Biometric Data?

A Cardholder’s Behavioural Biometric Data is a record of how that individual authenticates card payments online. It allows HSBC to identify individual Cardholders based on their keystrokes and device usage - this reduces the need for other forms of authentication (such as memorised passwords) as HSBC can use Behavioural Biometric Data to check it’s the Cardholder making the payment.

Further information on Behavioural Biometric Data will be available during the payment process when making purchases online.

What HSBC need from you

HSBC will still need to send an OTP to verify card payments, so it’s important the correct mobile phone number is recorded in MiVision for all Cardholders. Without this information, transactions may be declined as HSBC won’t be able to send an OTP.

Please make sure you check and if necessary update your mobile phone number via HSBC MiVision.

HSBC are here to help

For further information about SCA, you can read and download ‘Your guide to Strong Customer Authentication’ on HSBC's Corporate Card page.

If you have any queries relating to:

- Behavioural Biometric Data – call HSBC on 03455 873 8741 (or +44 1226 260 876 if you’re calling from outside the UK).

- Any other card queries – please call 03456 015 9342 or speak with your usual HSBC contact who’ll be happy to help.

Before the trip:

- Use Key Travel to book as much of your travel and accommodation as possible in advance to minimise the use of your card.

- Check with procurement-operations@exeter.ac.uk that the relevant travel and subsistence merchant categories have been unlocked for your card. This is to ensure you can purchase any incidental travel tickets, taxis and meals needed while travelling.

- Check your Mivision access - contact accountspayableenquiries@exeter.ac.uk if you have not yet set up your MiVision access

- Have your mobile number and e-mail correctly noted on Mivision.

- Know your PIN - request a reminder via MiVision, if needed.

- Know your memorable word and DOB as noted when your card was ordered or as you have amended

- Have the HSBC contact numbers saved on your mobile phone:

- Card Support 03456 015 934 or +44 1226 261 053

- Lost or Stolen 0800 032 7075 or +44 1442 422 929

During the trip:

- Use your PIN for the first transaction overseas and in each subsequent country visited to unlock the card for subsequent contactless payments.

- If changing SIM card while overseas, ensure MiVision is updated with the new mobile number, then updated again when swapping back to the original SIM.

When making payments abroad it is always worth advising HSBC bank of your travel plans pre departure, so they can flag against their security checks you will need to make payments abroad.

Whilst the above is best practice only, it should help in preventing issues while travelling.

17/01/22 Update

Further to the email of 21st December 2021 where we confirmed we had signed up to a single business account with Amazon for the whole of the University. This means our HSBC purchasing cards will work as normal, immaterial of the Amazon/Visa fee dispute outcome deadline on 19th January, when buying through our new Amazon Business account.

We are aware that general sales emails from Amazon are reaching colleagues encouraging them to ‘sign up to an account’ and whilst we transition to the University business account we have requested these be switched off.

We will start transitioning staff with HSBC credit cards across to the new central Amazon Business account from Friday 7th January 2022 and users can expect to receive an email from Amazon Business inviting them to join. The email will be from ‘NOREPLY@AMAZON’ and will act to link your log in details to the central account for future use. A pdf guide will also be included in the email from Amazon Business.

HSBC CARDHOLDER ACTION REQUIRED FOR EXISTING AMAZON.CO.UK USERS:

- From Friday 7th January 2022 Amazon Business will send an invite to you from noreply@amazon to join the main University Amazon Business account.

- If you have any issues joining Amazon Business, support is available to you by contacting Amazon Business Customer Service or alternatively you can book a one to one session with one of the Amazon Account Managers: Amy Wakeley and Max Goot. They will be available on Tuesday 18th January (12.30-17.30). They will send you a calendar invite so you can share your screen and help you migrate over to the central Amazon Business Account. Please contact Amy or Max direct to arrange - Amy Wakeley: wakeamy@amazon.co.uk / Max Goot: maxxgo@amazon.com

- Delivery addresses can be changed once you are linked to the new account

- For ease of transition, your current existing delivery address will be used on your new linked account.

- Delivery address changes can be requested through your Amazon account, once linked, for those who wish to adjust back to a work or office address

NON-CARDHOLDERS

The latest news from Amazon is that they are still working through their dispute with Visa but in the meantime have lifted their block for now so Visa credit cards will continue to be accepted after 19th January on the Amazon.co.uk site.

Staff who are Amazon customers but do not currently have an HSBC purchase card will be invited to join the University's Amazon Business account in the next stage of this project as this has wider benefits for the University and we do not yet know if the block may be imposed again if the dispute remains unresolved.

These staff should continue to use their current routes to purchase from Amazon (using a department purchase card, requesting Procurement Operations make the purchase on their behalf).

When a cardholder makes a purchase online, they may be asked to enter a one-time passocde (OTP) to confirm it is not fraudulent. HSBC will send the cardholder a unique 6-digit OTP by text to use in the online checkout.

To avoid transactions being declined because an OTP was not received, cardholders should keep MiVision up to date with their mobile phone number. If travelling abroad and using a temporary SIM, please update MiVision with that number.

If cardholders use their purchase card for department or team purchases, the cardholder must be present when their card is being used. Where a team or department regularly needs to use a purchase card but the cardholder is unavailable to receive OTP texts, then it may be approriate for another member of the team to be issued with their own purchase card. To apply, please discuss your requirements with your line manager then complete the Purchase Card Application Form.

For more information about OTPs, see HSBC's confirming online card purchases.

Cardholder MiVision Access

MiVision is a system that gives the cardholder the ability to view and manage your card transactions and statements online.

To log in for the first time you will need:

- Access to the internet and a web browser.

- The MiVision internet (URL) address: https://mivision.hsbc.co.uk/

- Your card number.

- MiVision uses pop up windows, so please ensure you have enabled pop ups.

Proxy Access

Cardholders can give someone else access to their MiVision to help with card management. This is called a proxy user and must be a member of staff. Non-staff such as family of the cardholder or students cannot be used as proxies.

How to set a proxy up depends on whether the person already has their own MiVision login (either because they are a cardholder themselves or they are already a proxy for another cardholder).

Set up a new proxy

The cardholder should email accountspayableenquiries@exeter.ac.uk confirming the name of the person they wish to be added to MiVision, the proxy's mobile phone number and cc the proxy in to the email..

The Accounts Payable team will set this up within two working days and arrange for a MiVison link to be sent to the proxy from HSBC in order to set up their security information.

Set up a proxy who is already a MiVision user

This is done by the cardholder within MiVision - see the MiVision Cardholder Guide

Please note - the proxy must use their University email address for the MiVision registration.

Change of limit is actioned via MiVision

Any change of card limit will need to be authorised by Finance Services.

https://mivision.hsbc.co.uk/

See page 8 of the MiVision Cardholder Guide

Genuine

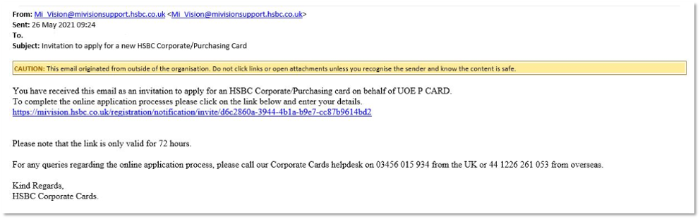

MiVision Set-Up Email - HSBC will send a link by email for new cardholders to set up their MiVison password and security number. This email will look like the following example:

This link is only valid for 72 hours and may arrive in your spam folder rather than your inbox. If the link has expired, please contact Accounts Payable to request a further copy.

PIN texts - as part of the card set-up process, HSBC will text the cardholder's mobile to ask if the PIN should be sent by text or post. The text will be repeated for several days if unanswered. This is a genuine message - please either reply'No' or ignore it and the PIN will be posted to the University for onward posting to the cardholder's address by default.

OTP texts - when the cardholder makes a purchase online, they may be asked to enter a one-time passcode (OTP) so that HSBC can confirm it is not a fraudster. HSBC send the cardholder a unique 6-digit OTP by text message to use. Going forward, cardholders may be asked to confirm online card payments more often. To help ensure cardholders are prepared for these changes, please keep MiVision up to date with your mobile phone number.

For more information on these upcoming changes, see confirming online card purchases.

Spam

Text messages that include a link to click on to confirm if a transaction/payment is genuine, to report a payment from an unknown or new device or to report a fraud are spam. HSBC will not send texts with such links.

Spam texts can be forwarded to 7726 (87726 for Vodaphone) free of charge which reports this message to your mobile phone provider. Once reported, the sender should receive an automated response thanking them for the report and giving further instructions.

This Which article may be helpful.

If prompted during an online checkout for the purchase card billing address, please use:

The Queens Drive

Exeter

EX4 4QJ

United Kingdom

No – in order to produce a VAT zero rate certificate for your supplier, the purchase must be made by purchase order using T1.

Help and support with VAT queries - VAT@exeter.ac.uk

You will need to repay the University and remove the item from your T1 purchase card statement. There is no need to inform HSBC that this item is a personal expense.

Please follow the steps in this guide - Purchase Card Used in Error

For one-off purchases <£1000, please email procurement-operations@exeter.ac.uk and include the following:

- Details of the item to be purchased.

- Attach the invoice or include a web-link to the item.

- The total cost (which should be less than £1000). Include VAT and delivery/service charges.

- The full budget or project code that will be used to pay for this item.

- If you are not the budget holder, please provide confirmation from the budget holder that you have permission to proceed with this purchase.

- The delivery address for this item.

No, it is not possible to add another user to a University purchase card - it must be held in a single name for security reasons.

Help & Support with Purchasing Cards

Please see our Purchasing Card guides for help with creating expense items and reconciling the card statement in T1.

For further help with T1, contact the Finance Helpdesk or call 01392 726981.